The sales tax rate is driven by where the receipt of goods take place.

- Departments located off-campus, within Davis city limits, are subject to the Davis district rate of 2% creating a total sales tax rate of 9.25%.

- Departments located on-campus, or in unincorporated areas of Yolo County, are subject to the California Sales tax rate of 7.25%.

Most vendors assign sales tax rates by zip code which can cause confusion when a zip code includes multiple tax districts. Because the core campus shares zip code 95616 with the city of Davis many vendors will charge the city rate of 9.25%.

- If the vendor’s system can accommodate the four digit suffix for the zip code, using the default zip code for campus is 95616-5270 will assess the correct tax rate of 7.25%.

- Vendors can confirm the 7.25% campus rate by searching under Davis on the CA Department of Tax and Fee Administration and their current listing of rates. The CDTFA has stated that the UC Davis campus rate is 7.25%.

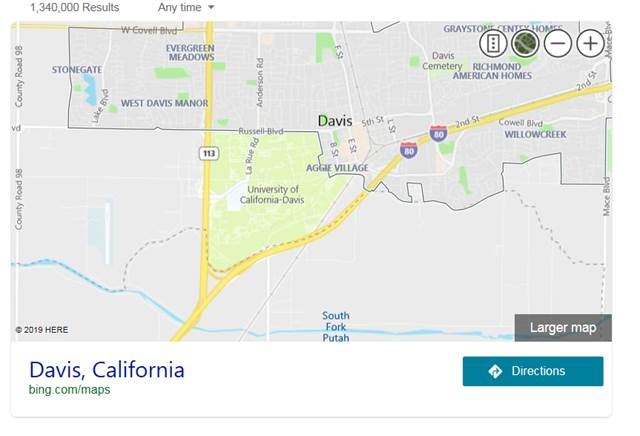

- The map excerpt below illustrates the main campus is not in the City of Davis and resides in the unincorporated area of Yolo County.

Receiving Goods at a Davis Vendor Location

If you are going to a vendor within Davis to purchase an item, you are subject to the 9.25% sales tax rate. You will need to change the Ship To zip on those orders to 95616 or 95618 as appropriate in order to calculate at the 9.25% rate.

Departments with AP Feeds

Please follow the instructions above relevant to your department's physical location. If your department should only pay the 7.25%, then make sure your feed sends the zip+4 (as indicated above) in place of the standard 95616 or 95618. If your feed sends 95616 or 95618, the system will use the 9.25% rate.

Procurement Card System-Assessed Tax

For Procurement Card purchases with out-of-state (non-California) vendors, the system will assess the tax rate based on the Ship-To Zip Code for your organization. The zip code indicated for your organization should be the one that is most frequently used for shipments.

If Use Tax has been incorrectly accrued, the department can submit an adjustment utilizing this web form.